INFLATION – how does it alter what you’re worth?

“Less is always more. The best language is silence. We live in a time of a terrible inflation of words, and it is worse than the inflation of money.” Eduardo Galeano

INFLATION – how does it alter what you’re worth?

“Less is always more. The best language is silence. We live in a time of a terrible inflation of words, and it is worse than the inflation of money.” Eduardo Galeano

“Less is always more. The best language is silence. We live in a time of a terrible inflation of words, and it is worse than the inflation of money.” Eduardo Galeano

I’m not sure in our present economic circumstances I totally agree with Eduardo Galeano. I do agree, in as much as, everywhere I look I seem to see screaming headlines without any context or any suggestion as to how to deal with our present problem of substantially increased and possibly still increasing inflation. A simple statement of the feeling of the impact of inflation: a general increase in prices and a fall in the purchasing value of money. In other words, an increase in the cost of living.

There are several ways to measure inflation; the most common three are RPI, CPI and CPIH.

- RPI – usually used to calculate the cost of living and wage escalation uses retail prices of a basket of goods and services.

- CPI – uses the weighted average change in prices over time of a basket of goods and services.

- CPIH – Consumer Prices Index including owner occupiers’ housing costs.

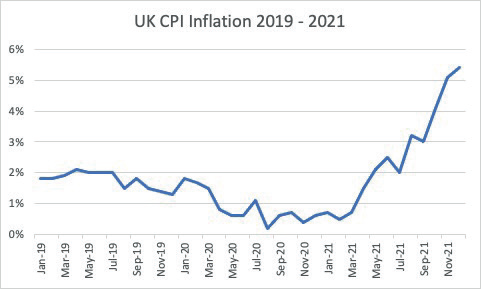

Any of them reflect the impact of the increase although CPI a measure usually gives a lower figure than RPI. Immediately prior to the Pandemic CPI was roughly following its 2% target as set by the Monetary Policy Committee of the Bank of England. With the impact of the CVID restrictions on the economy CPI inflation averaged just 0.9% in 2020. From July 2021 however, to December CPI inflation rose from 2% to 5.1%.

Source – https://www.rateinflation.com/inflation-rate/uk-historical-inflation-rate/

So, what does this mean for the impact of inflation on savings or investments? There are two things in particular to consider:

- the rate of inflation

- the rate of return on cash

The rate of inflation we’ve touched on. The simplest way to consider the rate of return on cash is the Bank of England base rate. However, it should be remembered that this is not just a rate of return but also an economic tool the Bank of England uses to make an economic impact.

Bank of England base rate sat at 0.1% from 19/03/2020 to 16/12/2021 when it rose to 0.25% and then to 0.5% on

02/02/2022. Interestingly that last rate decision was a majority 5-4 vote with the minority wanting to raise the rate to 0.75%.

So, there may be another rate change come the next meeting on the 17 March.

What follows is a very simple example but you can scale up for your own circumstances –

on £100 a 0.5% interest rate pays 50 pence which looks like a small positive return until you consider inflation.

The present rate of CPI inflation is 5.4%. On £100 5.4% gives £5.40 however this is a “negative” rate – what it costs, not what it returns.

So, you gain 50 pence and “lose” £5.40 an overall negative effect of £4.90.

In other words, by leaving your savings in cash your £100 is now worth £100 + 50 pence – £5.40 = £95.10

Or looking at it the other way round what had a cost of £100 now has a cost of £105.40. So, if you have £100 you can no longer afford to buy it which is ok if you can manage on part of it, whatever the “it” is that matters to you. Not so great if you wanted the complete it.

Can you offset the impact of inflation? – yes….. but … and there is always a but isn’t there.

“There is no such thing as a riskless hedge against inflation.” Edgar Fiedler.