Key Dates & Tax Year Planning — 2026/27

The UK Government 2025 Budget

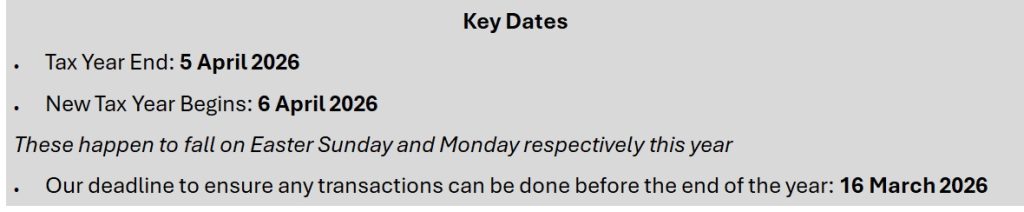

The current tax year ends on 5 April 2026, with the new one beginning on 6 April 2026.

A new tax year can bring changes to allowances and tax rules, while the end of the existing one provides a final opportunity to make use of remaining allowances and carry out any last-minute planning.

Please don’t wait until April to get in touch. Some transactions (particularly pension and ISA contributions or fund transfers) can take time to process.

To ensure you make the most of your available allowances, please note the key deadlines below.

What’s New for 2026/27

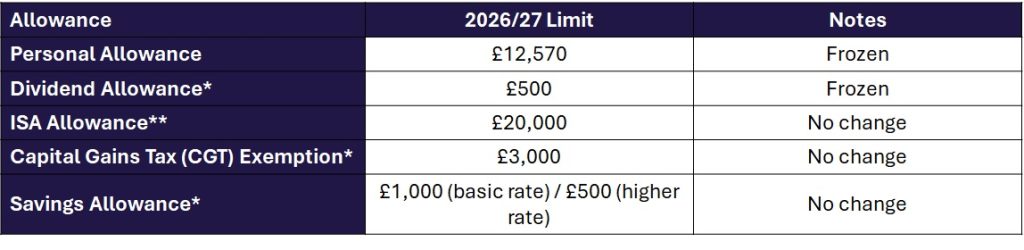

For clients with ISAs, Investment Accounts, and personal pensions, there are no major rule or allowance changes so far to watch for this year. However, several key thresholds remain frozen. *Please see our ‘Self Assessment 25-26’ information document for more information on whether you may be affected by these, and how to pay if you are

*Please see our ‘Self Assessment 25-26’ information document for more information on whether you may be affected by these, and how to pay if you are

**as announced in the Autumn budget 2025, the cash ISA allowance for under 65s only will be reduced to £12,000, but this will not take effect until April 2027. This will not affect investment ISAs

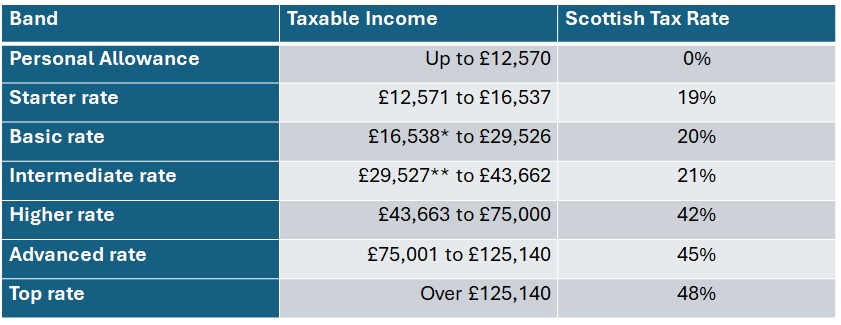

Scottish Tax Bands

While there have been no change with tax bands for the rest of the UK, two tax bands for Scotland have been increased slightly. This means a modest saving for taxpayers, as highlighted by this BBC article: https://www.bbc.co.uk/news/articles/c3r709rwpy0o

*increased from £15,398 **increased from £27,492

*increased from £15,398 **increased from £27,492

Other Considerations

- One year remaining before pensions form part of the estate for inheritance tax purposes. See our Inheritance tax & your pensions document for more information.

- Bed & ISAs and Bed & Pensions remain tax-efficient ways to use allowances. See below for more information.

Action Points

- Consider using Bed & ISA or Bed & Pension options to make full use of allowances.

- Contact us before 16 March 2026 to allow time for processing and fund transfers.

If you are unsure about whether you should be taking action before the end of the tax year, be it making a tax-efficient transfer or assessing whether you may be liable for tax, if you are an existing client then please update your Fact Find on our CashCalc system. This helps us check your position. This would also be a useful thing to do if you’re unsure if your estate will be subject to Inheritance Tax, either now or in the future.

If you have not already signed up to our CashCalc system then please email us for details at enquiries@eisfs.co.uk

What is a ‘Bed and ISA’?

An ISA offers a tax-free environment for your investment to grow with a limit of £20,000 of new contributions every taxy tear. Therefore, if you have funds invested outside of an ISA (e.g. an Investment Account) we recommend moving £20,000 each year to take advantage of the tax-free status of the ISA.

This recommendation will typically be made at your annual review but please feel free to contact us about it at any other time.

What is a Bed and Pension?

A Bed and Pension works in a similar way to a Bed and ISA, but instead of moving money into an ISA, it’s paid into your pension. This can be beneficial because pension contributions normally receive tax relief, which boosts the amount invested and so is an efficient way to increase pensions savings. A transfer from either an ISA or from an Investment Account into a pension is possible.

Be aware that tax relief is only available up to age 75, and contributions are also limited by your annual allowance (£3,600 for retirees).

When investing money for income or growth, you are placing your capital at risk as the value of investments may go down as well as up. You might end up with less money than you started with. No guarantees can be given with regard to future performance / returns.

The information is based on our understanding of legislation, whether proposed or in force at the time of writing.

You voluntarily choose to provide personal details to us via this website. Personal information will be treated as confidential by us and held in accordance with the Data Protection Act 2018. You agree that such personal information may be used to provide you with details of services and products in writing, by email or by telephone